Publicado por T&B Petroleum

05/01/2017

Divulgation

DivulgationOn December 5th, 2016, the Mexican National Hydrocarbons Commission (“CNH”) held a bidding round of areas for the exploration and production of oil and natural gas in deep and ultra-deep waters in the Gulf of Mexico. It was very successful. Blocks were offered in the “Perdido” Area and the “Salina del Istmo” Basin. Also on offer was a 60% stake in the “Trion” Field to be operated in a consortium with Petroleos Mexicanos – PEMEX.

Eight of the ten blocks offered were awarded to international oil companies, including CNOOC, Total, Statoil, BP, INPEX, Chevron and Exxon Mobil. BHP Petroleum acquired the stake in the “Trion Field”.

According to the bidding rules for the Perdido and Salina del Ismo blocks, the winning bids were selected in accordance with the highest score obtained, taking into consideration the percentage of royalties offered and the investment commitment bid in the exploration phase, in addition to the minimum set forth in the tendering procedure, as per the following formula:

VPO = 4 × [Regalía Adicional + (11.5 x Regalía Adicional / 100 + 3.45) x Factor de Inversión]

Where:

“VPO” is the weighted value of the economic bid

“Regalía Adicional” is the additional amount of royalties determined by a percentage of the contract value of the hydrocarbons

“Factor de Inversión” is the variable regarding the investment commitment on the Exploration Stage

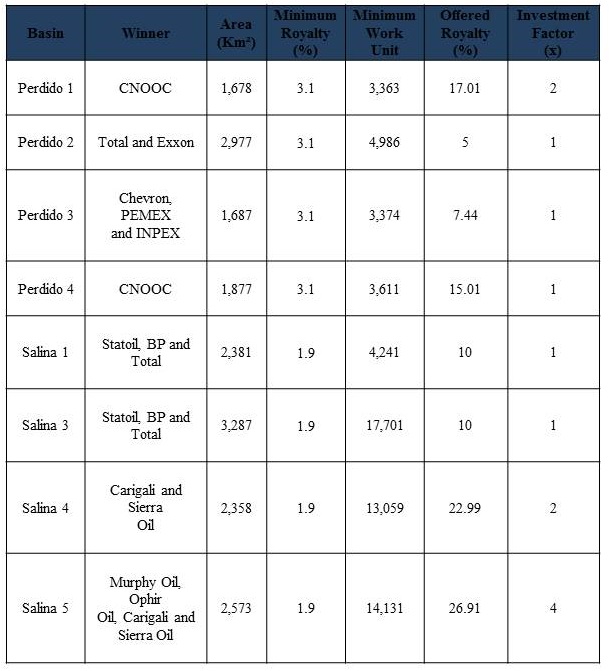

The results of the Mexican round are set out in the chart below:

For the Trion Field, the first criteria used to choose the bid was the value of the royalties which, in case of a tie, was followed by the signature bonus and PEMEX’s carry in the Joint Operating Agreement. In fact, PEMEX’s carry is essential for the company due to the losses recorded in its balance sheet since 2012.

In the Mexican model, the exploratory stage lasts 10 years, divided into 3 exploratory periods; the assessment stage can last up to 3 years and the development phase can last for up to 22 years, with the possibility of two extensions, totaling 15 years.

Mexico began its program in December, 2013, with the approval of the constitutional reforms needed to open up the upstream sector, long after “Round Zero” in Brazil in 1998. The Mexican model of market opening was largely inspired by the Brazilian regime, but the country can take credit for adapting itself quickly to make the rules more attractive to investments, soon after the unconvincing results of the first phase of “Ronda Uno”. Certainly, PEMEX does not have the technical staff or experience in offshore operations the way Petrobras has, but so far it has adapted its role in the industry in Mexico, in the light of the global reality of the sector.

In Mexico, differently to the Brazilian regime, local content is not included in the bid, but it is previously defined by the tender rules and varies generally from 3% to 8% for the exploration stage, and from 4% to 10% for the development stage.

In an ever-increasingly competitive environment for attracting investments in hydrocarbon exploration activities, the success of the Mexican round demands, therefore, a serious re-assessment of the viability of the exploratory block bidding model adopted in Brazil. In other words, is the current concession model based on the equation of: (signature bonus) + (local content) + (minimum exploratory program investments) adequate to attract new investments to the sector?

Part of this re-assessment concerns regarding the local content policy adopted by the Brazilian government in the last upstream rounds, with minimum percentages required by Brazil’s “Round 13” ranging from 37% to 70% in the exploration stage, and from 55% to 77% in the development stage, depending on the location of the block (whether deep or shallow water or onshore). The question is whether local content should remain an integral part of the offers in the upcoming exploratory block tenders, or whether it should be at least corrected to include investments in the local market for goods and services or to expand the list of items exempt from the local content commitment (“waiver”).

Another observation would be to review the concession contract adopted by the Brazilian National Petroleum Agency (“ANP”) to include more realistic deadlines for the fulfillment of the minimum exploratory program by the concessionaires, given the current scenario of the O&G industry. In the scope of this review, one fundamental issue would be the adoption of an arbitration clause aligned with international practice, in order to reduce the chances of conflicts occurring concerning the arbitrability of issues related to the concession.

However, the main issue to be taken into consideration at this moment concerns the regulatory uncertainties that make up so-called “Brazilian Risk”. A number of regulatory uncertainties have appeared in recent years, whether by way of the cancellation of the Brazil’s “Round 8” in 2006 by the CNPE, or the interruption of rounds between 2008 and 2013, or even by the politicization in the decision-making process of the regulatory agencies, in recent years.

The uncertainty regarding institutions is also shown by the inefficient multiplicity of agencies (ANP, National Council of Energy Politics – CNPE, Ministry of Mines and Energy – MME and PPSA), and by controversies and conflicts between them regarding competence in the upstream sector. By way of illustration, we refer to the controversies (i) between Petrobras and the Federal Audit Courts (“Tribunal de Contas da União”) regarding the bidding model adopted by the company, (ii) between Petrobras and the Judiciary regarding the company’s divestment program, (iii) between the ANP and CNPE regarding competence to set the parameters of the reference price for calculation of royalties, (iv) between concessionaires and the ANP regarding local content obligations, and (v) between concessionaires and the State of Rio de Janeiro on the legality of the new tax requirements in the upstream sector.

Mexico is preparing itself for a new bidding round in March, 2017 and Brazil is reportedly also going to promote rounds for pre-salt and post-salt blocks in 2017. Will we once again feel the effects of Tequila in the Country of Caipirinha?

Font: Valois Pires and José Eduardo Siqueira